Austin Market Update March 2025: Hottest ZIP Codes to Watch

Table of Contents

- Introduction to the March 2025 Austin Market Update

- March 2025 Austin Real Estate Market Update – ZIP Codes Where Housing Prices Are Soaring

- March 2025 Austin Real Estate Market Update – ZIP Codes Where Housing Prices Are Sinking

- What This Means for You

- March 2025 Austin Market Update – How We Analyze the Real Estate Data

- FAQs About the March 2025 Austin Market Update

- Conclusion on the March 2025 Austin Market Update

Introduction to the March 2025 Austin Market Update

Hi, we're Alisha and Matthew Wilson from Austin Suburbs. In this March 2025 Austin Market Update we break down the neighborhood-by-neighborhood swings driving opportunity — and risk — across the Austin metro. Headlines might tell you "the market is crashing," but the real story is much more nuanced. Some ZIP codes are seeing dramatic price gains, while others are cooling off quickly. If you're planning a move, buying, or selling in 2025, this is the kind of insight that can mean the difference between a big win and a costly mistake.

We dig into the data and the local developments shaping demand so you can make a smart decision for your family and finances. Throughout this market update we’ll cover the biggest winners, the ZIP codes showing the steepest declines, and what those trends mean for buyers and sellers. We'll also highlight new projects, job drivers, and neighborhood amenities worth watching.

VIEW MORE HOMES FOR SALE IN AUSTIN TEXAS

March 2025 Austin Real Estate Market Update – ZIP Codes Where Housing Prices Are Soaring

Let’s get into the good news first. In the March 2025 Austin Market Update we identified three clear winners: 78703 (Tarrytown and Clarksville), Taylor (northeast of Austin), and Round Rock. Each of these areas has its own demand drivers — from classic urban charm to large-scale job creation — and each is delivering strong results right now.

ZIP code 78703 — Classic Austin luxury and rare inventory

Winner number one is 78703, the area that includes Tarrytown and Clarksville. In this March 2025 Austin Market Update, median prices in 78703 jumped to around $1,320,000 — that's roughly 140% higher than the same time last year. Almost 70% of homes in this ZIP code sold for over $1 million.

Why such a dramatic rise? Several factors are converging here:

- Rarity of inventory. These neighborhoods offer mature trees, large lots, and established homes — attributes buyers chase in any market.

- Proximity to downtown. Buyers who want short commutes and walkable lifestyle are willing to pay premiums.

- High-end new development. The buzz around the new mixed-use project "Sixth and Blanco" in the heart of Clarksville — with ultra-premium homes and luxury retail — has helped push demand and expectations upward.

For sellers in 78703, it’s an enviable market: motivated buyers with deep pockets are active and competition among offers is common. For buyers, be prepared to move quickly and to compete with cash and aggressive offers.

Taylor — Affordable now, but changing fast

Our second big winner is Taylor, northeast of Austin. In this March 2025 Austin Market Update Taylor’s median home price is around $318,000, and an amazing 95% of homes sold for under $500,000.

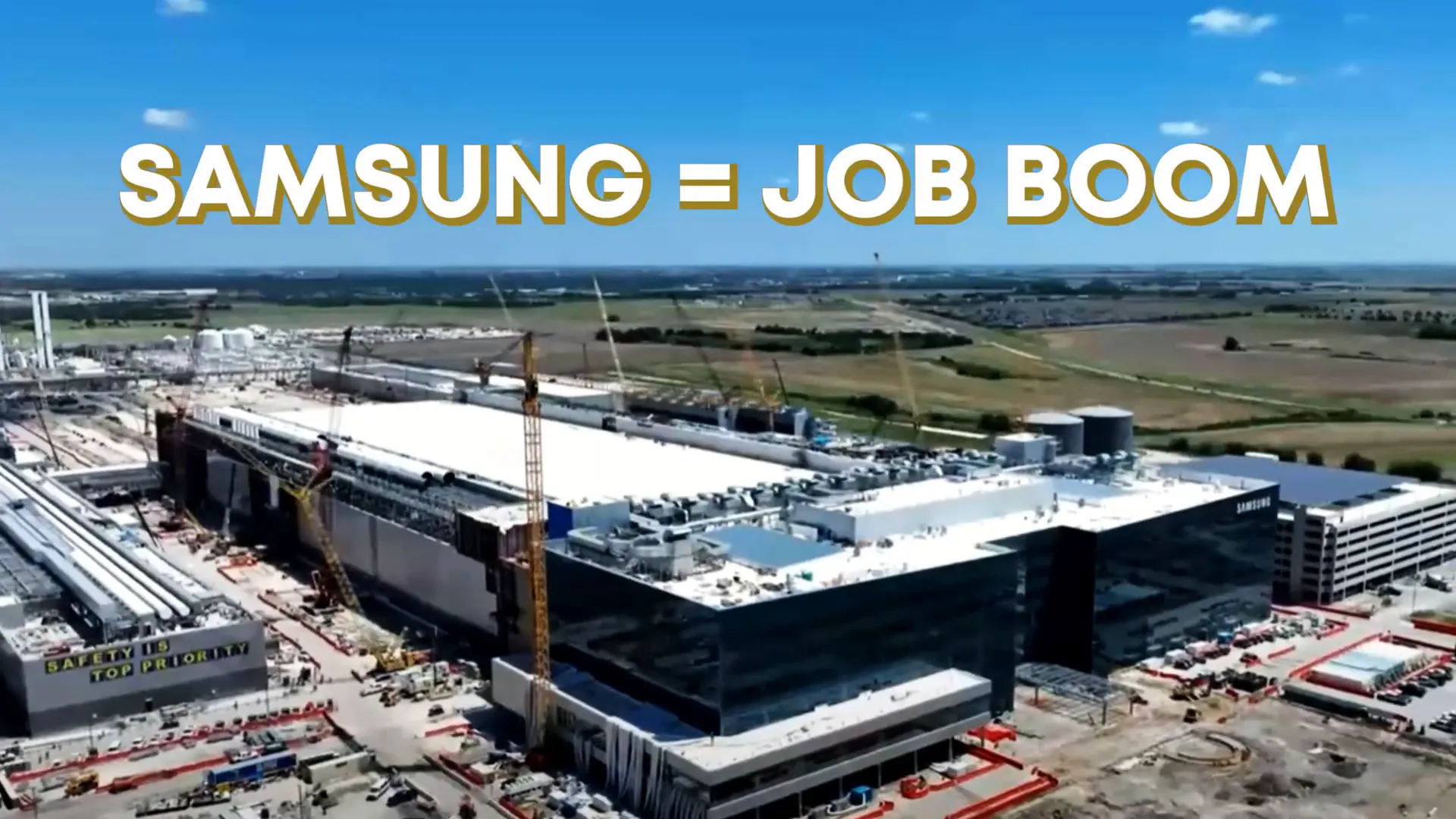

So what’s driving the rapid appreciation and interest in Taylor? The arrival of Samsung's new chip factory — a multi-billion-dollar investment — is bringing thousands of jobs and a surge of housing demand. Large employment projects like this change housing dynamics quickly: workers need places to live, new services and retail follow, and local wages and competition for inventory increase.

If you’re looking for a relatively affordable option within reach of new job growth, Taylor is one to watch — but the window for affordability may be closing fast.

Round Rock — steady performer, new district growth

Round Rock continues to prove itself as one of the Austin area’s most consistent markets. In our March 2025 Austin Market Update the median price is about $430,000, with 71% of homes selling under $500,000. Sales were up roughly 7% compared to last year.

What buyers and relocating families like about Round Rock is straightforward:

- Top-rated schools and family-friendly neighborhoods.

- Shopping, dining, and parks that serve a broad range of lifestyles.

- New mixed-use centers like "The District" that add jobs, restaurants, and walkable amenities.

Round Rock is performing well because it offers a balanced mix of affordability and lifestyle — an attractive combination for buyers priced out of central Austin but seeking quality-of-life and convenience.

March 2025 Austin Real Estate Market Update – ZIP Codes Where Housing Prices Are Sinking

Now for the softer side of the market. In the March 2025 Austin Market Update we highlight a few ZIP codes showing significant weakening. These are places where inventory, new construction, rising interest rates, or shifts in buyer sentiment have led to meaningful drops in sales or median price.

Zip code 78756 — Rosedale, Allandale, and Brentwood

One of the most surprising pullbacks is in 78756, which includes Rosedale, Allandale, and Brentwood. Here we saw sales drop a dramatic 75%, and median prices dipped to around $650,000 — a 27% drop from last year. Homes are staying on market longer and buyers are more hesitant.

That sounds alarming, but there's an important context: large, new mixed-use communities are reshaping the local scene. Right next to these older neighborhoods is The Grove, a fast-growing mixed-use development adding stylish homes, restaurants, retail, and public green space. Developments like The Grove can flip a perceived slowdown into long-term opportunity, particularly for buyers who get in before finishing phases are complete.

We often see cycles where established neighborhoods cool while adjacent redevelopment heats up. For property owners in Rosedale and Brentwood, keeping an eye on The Grove and similar projects is critical — those projects can shift demand patterns quickly.

Liberty Hill — supply outpacing demand

Liberty Hill, a suburb that experienced rapid growth, is currently under pressure. Over the last year home sales dropped about 32% and properties are averaging nearly four months on the market. Median home prices hovered near $450,000.

Why the slowdown? Builders in Liberty Hill ramped up production quickly. When supply spikes before consistent demand arrives, the market temporarily tilts in buyers' favor. That’s exactly what’s happening now: many new communities like Santa Rita Ranch with resort-style amenities are attracting long-term interest, but in the short term there are simply more homes than buyers.

Liberty Hill remains attractive for long-term buyers who want newer construction and top-rated schools while stretching their housing budget. But for sellers who bought during the boom and expect to flip quickly or sell at a large gain, patience may be necessary.

Zip code 78748 — South Austin (Slaughter Creek, Olympic Heights)

Finally, 78748 in South Austin — including Slaughter Creek and Olympic Heights — is slower right now. Sales are down about 42% year-over-year and the median sale price dipped roughly 4% to about $419,000. While around 66% of homes still sell under $500,000, rising interest rates have pushed many buyers to the sidelines.

The long-term outlook isn't bleak: new entertainment and development along corridors like Menchaca Road are adding amenities and appeal. For buyers, that means potential upside if you can lock in an affordable mortgage and tolerate a slightly slower resale timeline. For sellers, pricing right and staging to highlight lifestyle advantages will be essential.

What This Means for You

So what should buyers and sellers take away from this March 2025 Austin Market Update? The short answer: location matters more than ever. Across the Austin metro the market is fragmenting into pockets of strength and weakness. Here are our practical recommendations for each group.

For sellers

- If you’re in 78703, Taylor, or Round Rock, this is a market where buyers are active and often aggressive. Price competitively and your home can attract strong offers; presentation and timing still matter.

- If you’re in a slowing ZIP code like 78756, Liberty Hill, or 78748, expect longer days on market and potentially more negotiation. Consider making targeted investments (landscaping, minor updates, staging) to stand out and price for the current demand environment.

- Work with an agent who understands micro-markets and can help you time your listing and marketing — not all neighborhoods move together.

For buyers

- Shop where conditions favor buyers if you need a deal: areas like parts of Rosedale/Allandale, Liberty Hill, and sections of South Austin have more inventory and less bidding pressure right now.

- In hot ZIP codes, be prepared with pre-approval, a fast decision process, and flexibility on timelines; you may need to offer competitive terms to win.

- Consider job-driven growth areas (Taylor, Round Rock) for investment potential, but beware of buying at peak optimism without room in your budget.

Across the board, interest rates and mortgage qualification rules continue to shape what buyers can afford and how quickly inventory turns. Local development — large employers, mixed-use projects, and retail corridors — also shift buyer preferences faster than ever. That’s why we treat every market update as a neighborhood-level diagnosis, not a blanket statement about Austin as a whole.

March 2025 Austin Market Update – How We Analyze the Real Estate Data

We rely on multiple sources: MLS activity, public sales records, and local intel from builders, community leaders, and municipal development updates. When we say a ZIP code is up or down, we’re looking at recent median sale price, percent of homes selling under certain price thresholds, days on market, and year-over-year sales volume changes.

Understanding the "why" behind the numbers is our focus. A sales drop could mean seasonal softness, a buyer wait-and-see reaction to rate changes, or a supply surge from new construction. Knowing which one helps you act strategically.

FAQs About the March 2025 Austin Market Update

Is the overall Austin market crashing?

No. The March 2025 Austin Market Update shows the market is not universally crashing — it's shifting. Some ZIP codes are booming, others are cooling. The key is micro-market analysis. General headlines miss local nuance.

If I own a home in a cooling ZIP code should I panic?

No. Cooling means you might need to be more strategic about pricing, staging, and timing. Some neighborhoods are simply experiencing a temporary oversupply or price reset. Many of those areas also have long-term upside because of schools, redevelopment, or planned amenities.

Should I buy in Taylor now because it’s still relatively affordable?

Taylor offers a unique opportunity tied to Samsung and related job growth. If you need affordability and will be in the home long-term, Taylor could be a smart buy. If you plan to flip quickly, be mindful that rapid appreciation can slow if job expansion timelines shift.

How do I know which neighborhood is right for me?

Start by prioritizing must-haves: schools, commute, lifestyle, and budget. Then layer in market dynamics: is inventory tight, are buyers paying premiums, is there major development or employer growth that changes demand? We can run neighborhood-by-neighborhood analysis for your specific timeline and goals.

How often should I get a market update?

We recommend at least quarterly if you’re actively considering a move, and monthly if you’re preparing to list or buy in the near term. Local conditions can change quickly, especially with new employment or large-scale development announcements.

Conclusion on the March 2025 Austin Market Update

In this March 2025 Austin Market Update the headline is simple: location matters. 78703, Taylor, and Round Rock are the strongest performing markets right now — buyers are active and competition is high. On the flip side, parts of 78756 (Rosedale/Allandale/Brentwood), Liberty Hill, and 78748 (South Austin) are experiencing slower sales and price pressure, creating potential opportunities for buyers who act strategically.

Whether you're moving in 10 days or 10 months, the right local strategy makes all the difference. If you'd like a neighborhood-level analysis tailored to your goals — whether that’s maximizing your sale price or finding the best deal — reach out. We offer personalized consultations by phone, text, email, or Zoom and would love to help you plan your next move.

If you're interested in buying a home, feel free to call or text us at 737-372-6777 or visit our www.austin-suburbs.com for more information. We're here to assist you every step of the way!

What do you think — are these swings temporary, or do they signal larger structural changes in the Austin market? Drop us a note or reach out directly. We read every message and are happy to walk you through options for buying or selling in these shifting neighborhoods.

Thanks for reading this March 2025 Austin Market Update. We’re Alisha and Matthew Wilson — if you want help navigating these neighborhood-by-neighborhood shifts, get in touch and we’ll show you the Wilson way!

Alisha & Matthew Wilson

With years of experience in both residential and investment properties, they are dedicated to helping clients navigate Austin’s thriving market.

LIVING IN Austin TX

Specializing in relocation and real estate investment, they provide expert advice and guidance to help you find your dream home or investment property in the vibrant Austin market. Tune in for helpful tips, neighborhood tours, and insights on living in Austin.