7 Things NO ONE Tells You About the Cost of Living in Austin Suburbs

Table of Contents

- Introduction to Cost of Living in Austin Suburb

- The Hidden Tariff Tax in Austin

- Property Taxes Explained: Austin, Pflugerville, Round Rock & Georgetown

- Why the Market Now Favors Buyers

- Hidden Monthly Costs Beyond Your Mortgage

- Healthcare Costs in Texas

- The Real Monthly Budget for Austin Suburb Living

- Why Having a Buyer’s Agent in New Construction Matters

- Final Takeaways

- FAQs About the Cost of Living in Austin Suburbs

Introduction to Cost of Living in Austin Suburb

The cost of living in Austin suburbs sounds great until the bills start stacking up faster than your Amazon packages. If you are thinking about a move to the Austin suburbs, you need to look beyond list prices and into the full monthly picture. In this article I break down the hidden line items, explain how tariffs and taxes are changing the math, and give real numbers so you can budget with confidence.

The phrase cost of living in Austin suburbs isn't just about mortgage payments. It includes tariffs on materials, property taxes, utilities, commuting, groceries, healthcare, and even the small things like dog grooming or delivery fees. If you only plan for a mortgage you will be surprised. We saw one figure in our numbers that made us double check the math — and I promise, the final total will make you pause before packing for Pflugerville.

The Hidden Tariff Tax in Austin

One of the earliest surprises for new home buyers is the tariff tax. Economists and budget labs are calling this a quiet, real cost that lands on many households now. According to recent analysis, these tariffs are adding roughly $2,400 a year to the average household's expenses. For new construction buyers the impact is even larger because tariffs hit building materials directly.

Here is the short list of tariff impacts you need to know for new homes: 10 percent on lumber, 25 percent on steel, and projections of up to 50 percent on cabinets and vanities by early 2026. Those are not small numbers. The result: new home starts in the Austin area dropped about 14.5 percent year over year as builders pause, sit on lots, and wait for policy clarity.

What does this mean for you? If builders pull back, incentives for ready-to-move-in inventory tend to increase. Builders like DR Horton have indicated they will keep sales incentives elevated to move inventory through the end of 2025. That creates a window where the cost of living in Austin suburbs for a buyer can actually be lower when you take builder credits, lender incentives, and lower competition into account.

Property Taxes Explained: Austin, Pflugerville, Round Rock & Georgetown

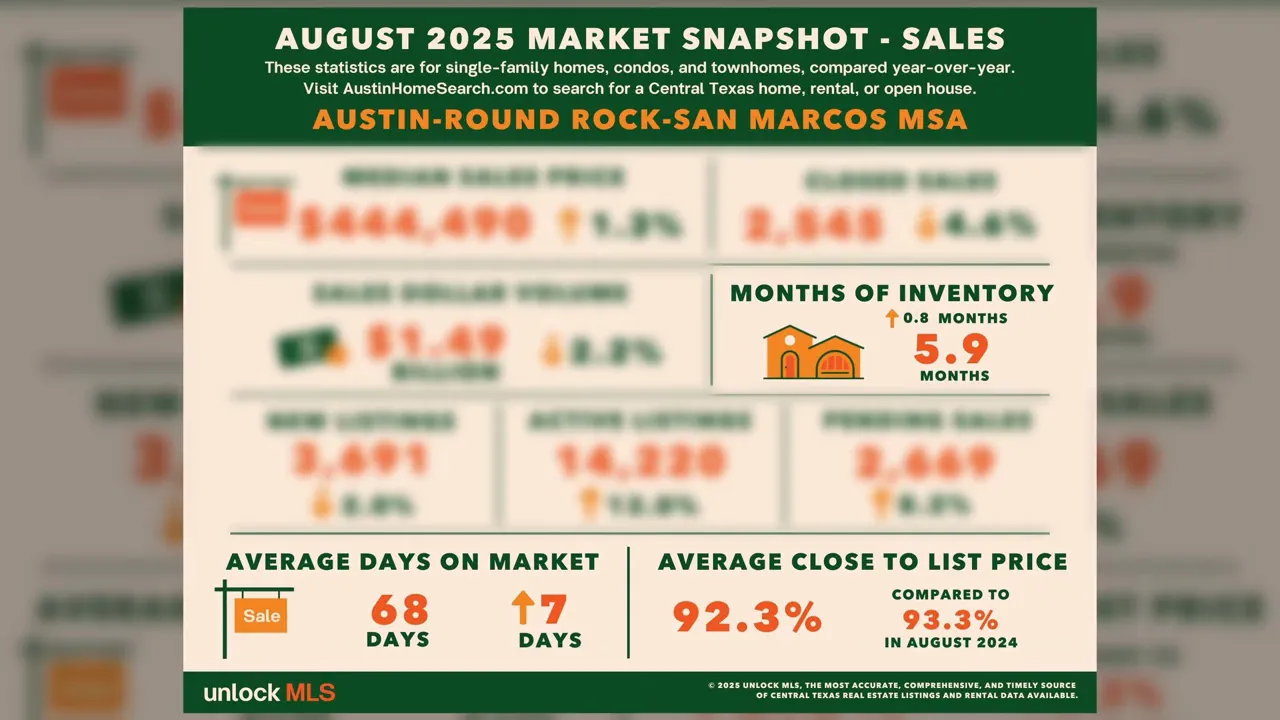

The biggest line item in most monthly budgets is the home itself — but property taxes are often the heavy weight that buyers underestimate. As of August 2025 the median home price in Austin metro sits around $440,000, up just 1.3 percent year over year. Mortgage rates around 6.32 percent give buyers breathing room, until property taxes are layered on.

Here are the effective tax rates we referenced for comparison: Manor sits at about 2.07 percent, Pflugerville 1.82 percent, Round Rock 1.8 percent, Austin 1.65 percent, and Georgetown 1.53 percent. Even a small percentage difference between suburbs can add up to thousands of dollars each year in tax bills.

Travis County raised its tax rate by 9 percent this year, adding roughly $200 a year to the average homeowner's bill. Round Rock rose by 6.9 percent. Georgetown ISD technically lowered its rate but rising property values mean most owners still pay more. The state does offer a $100,000 homestead exemption which lowers taxable value — for example $500,000 becomes $400,000 — and there is a proposed ballot to increase that exemption to $140,000 that could reduce future bills further.

Bottom line: When comparing suburbs, always run the math for property taxes. Choosing Georgetown over Manor can save you thousands a year. That tax difference is a core part of the true cost of living in Austin suburbs and should be part of your decision, not an afterthought.

Why the Market Now Favors Buyers

For the first time in years, the market favors buyers. Inventory has expanded to about 5.9 months, meaning sellers can no longer simply name their price. Average days on market are around 68 and homes are closing at roughly 92 percent of list price. That creates negotiating leverage: builder incentives, upgrades, and closing cost credits are more common than they were during the frenzy.

Rates are also slightly friendlier than last year. The average 30-year mortgage rate around October 10 was about 6.3 percent, down from 6.64 percent the same time last year. That change saves buyers roughly $175 a month or around $2,000 annually. New construction buyers can sometimes access in-house financing as low as 2.99 percent, because builders are using lender incentives to move inventory and offset higher construction costs.

Out of state buyer traffic dropped from about 55 percent to 25 percent, which reduces bidding wars and increases your negotiating power. If you are watching the cost of living in Austin suburbs, this buyer-favored window is one of the best times to secure value, especially with ready-to-move-in homes.

Hidden Monthly Costs Beyond Your Mortgage

The mortgage is the headline number but it is not the whole story. Once you close the real spending begins. Bigger homes mean bigger bills. For a typical 3,000 square foot home expect utilities between $350 and $450 per month, and during hot Texas summers energy bills can exceed $500 with two AC units running full time.

Water, sewer, trash, and internet add another $150 to $200 a month depending on your community and service options. In some suburbs you have multiple internet providers; in others you might only have one choice. That matters — because price and quality vary significantly.

Commuting should be included in your estimate for the cost of living in Austin suburbs. Two cars with full coverage insurance, gas, and maintenance typically run $800 to $1,100 per month. Add tolls if you drive into Austin frequently, and time in traffic which has its own opportunity cost. Groceries are about 3 percent below national average with food inflation, but you should still expect $700 to $900 per month for a household. Dining out can add $800 to $1,200 a month if you enjoy Austin’s vibrant restaurant scene or use food delivery frequently.

Even without the mortgage, many households spend $2,000 to $3,000 per month to keep daily life running smoothly. That is why the cost of living in Austin suburbs cannot be reduced to just a mortgage calculator. You need to include lifestyle choices, commuting patterns, and household size to get the full picture.

Healthcare Costs in Texas

Healthcare in Texas can be expensive and Austin runs slightly higher than the national average. If you are on an employer plan expect to pay $200 to $400 per month for your share of premiums. Marketplace or individual coverage commonly ranges $400 to $500 per month, and premiums increased about 24 percent this year. Routine doctor visits and specialist care can be costly before insurance.

The upside is access to strong hospital networks like Dell Medical, St. David's, and Ascension Seton. Many people budget $300 to $400 per month for healthcare costs including prescriptions and co-pays to avoid surprises. When you model the cost of living in Austin suburbs be conservative with medical estimates because unexpected bills can derail a tight budget quickly.

The Real Monthly Budget for Austin Suburb Living

After we added mortgage, taxes, insurance, HOA, utilities, food, transit, and healthcare here is a practical example. For a $600,000 Round Rock home expect roughly $8,400 to $9,500 per month all in. That covers everything from mortgage payments to day to day living costs.

On a household income between $200,000 to $330,000 that equates to about 30 to 35 percent of income. With Austin’s median household income at around $95,000, that means many buyers will be operating well above the median to afford this level of suburban living. Homestead exemptions and builder incentives can help lower that monthly burden, but they rarely erase the underlying cost differences between suburbs.

Our practical advice: don’t buy the biggest house you can afford. Buy the home that fits your comfort zone and long-term goals. Use real numbers, not aspiration, and plan for the full monthly cost so you buy confidence not stress.

Why Having a Buyer’s Agent in New Construction Matters

Moving to the Austin suburbs is not only about picking a floor plan. Every suburb, builder, and community comes with pricing structures, incentives, and fine print. The sales rep in the model home works for the builder, not for you. Their job is to protect the builder’s bottom line. Our job — and the job of a buyer’s agent — is to protect yours.

In most cases builders cover buyer agent commission, but each situation differs. Having your own agent from day one ensures you know who pays for what, avoids surprises, and helps you negotiate incentives that reduce the true cost of living in Austin suburbs. We help people understand contracts, incentives, taxes, and long-term costs so surprises are rare and avoidable.

Final Takeaways

The cost of living in Austin suburbs is a full-picture game. Mortgage payments matter, but tariffs, property taxes, utilities, commuting, food, and healthcare all combine to determine what your monthly life really costs. Right now the market gives buyers an advantage with higher inventory and builder incentives, but tariffs and property values keep pressure on long-term costs.

If you are thinking about moving to the Austin suburbs , run the numbers for your target suburb, factor in homestead exemptions, builder incentives, and realistic utility and commute costs. Plan for unexpected medical bills and be conservative with lifestyle spending. When you plan with real numbers you buy confidence, not stress.

FAQs About the Cost of Living in Austin Suburbs

What is the biggest hidden cost when moving to the Austin suburbs?

Property taxes and tariff-driven construction costs are among the biggest hidden expenses. Property tax differences between suburbs can amount to thousands annually, and tariffs increase new construction costs which builders often pass on or respond to with inventory slowdowns and changing incentives.

How much do tariffs add to a household's expenses?

Analyses show tariffs are quietly adding about $2,400 per year to the average household's expenses. For new construction buyers, tariffs on lumber, steel, and cabinets can make the impact substantially higher.

Can choosing a different Austin suburb really save me thousands?

Yes. Moving from a higher-rate suburb to a lower-rate one can save thousands each year in property taxes alone. Also consider commute, utilities, and HOA fees which vary by community and affect your monthly cost of living in Austin suburbs.

Are builder incentives a real way to lower costs?

Yes. When construction slows builders often offer financing incentives, closing cost credits, and upgrades to move inventory. Those incentives can materially reduce your upfront and monthly costs, especially if you use a buyer's agent to negotiate them.

How much should I budget monthly for utilities, food, and healthcare in Austin suburbs?

Expect utilities for a larger home to be $350 to $450 monthly, groceries $700 to $900, dining out $800 to $1,200 depending on habits, and healthcare $300 to $400 set aside to cover premiums, copays, and prescriptions. Combined, non-mortgage household costs often range $2,000 to $3,000 monthly.

Do I need a buyer’s agent for new construction?

Yes. A buyer’s agent represents your interests, helps explain contracts and incentives, and ensures you understand who pays for what. Model home reps work for the builder, so having your own agent protects your bottom line.

Need help moving to any Austin suburb? Connect with us.

Ready to make a move or want a personalized cost breakdown for your target suburb? Call or text us at 512-648-2828 and we'll schedule a FREE Zoom consultation — whether you're moving in 10 days or 10 months. We’ll walk you suburb-by-suburb, run the real numbers, and represent your interests as your buyer’s agent.

Alisha & Matthew Wilson

With years of experience in both residential and investment properties, they are dedicated to helping clients navigate Austin’s thriving market.

LIVING IN Austin TX

Specializing in relocation and real estate investment, they provide expert advice and guidance to help you find your dream home or investment property in the vibrant Austin market. Tune in for helpful tips, neighborhood tours, and insights on living in Austin.